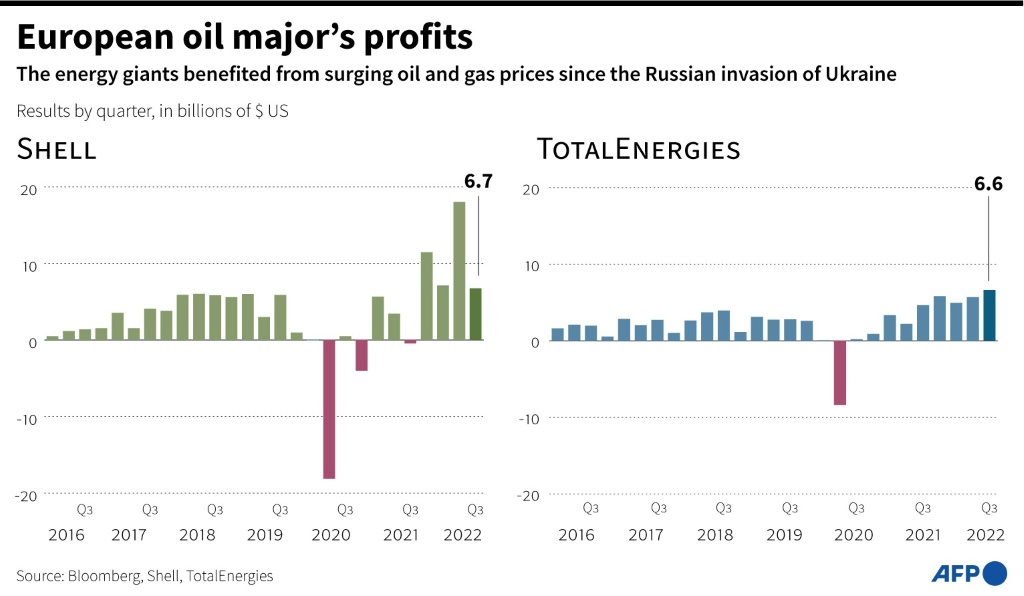

The billions in profits announced by TotalEnergies and Shell on Thursday have revived the debate over windfall taxes on the thriving energy giants.

As millions struggle with higher energy bills and inflation, there have been mounting calls for a much bigger tax to be placed on energy companies that have benefitted from price fluctuations.

In Paris, TotalEnergies said surging global oil and gas prices had helped it post a massive jump in profits in the third quarter.

In London meanwhile, British energy giant Shell announced net profit totalling $6.7 billion in the third quarter.

Net profits at TotalEnergies soared 43 percent from the same period last year to $6.6 billion, with record performances for its natural gas and liquefied natural gas (LNG) activities.

The firm has now earned $17.3 billion over the first nine months of the year, more than the $16 billion in profits it posted last year.

Shell’s result Thursday compared with a loss after tax of $447 million in the July-September period last year, the company said.

Flush with cash from revenue surging to almost $100 billion, Shell said it would buy back shares at a cost of $4 billion.

Both sets of results will fuel raging debate over sizable profits by energy firms due to the spike in prices thanks to the Russian invasion of Ukraine.

– Pressing the giants –

In France, the leftwing opposition is pressing for a windfall tax to help fund measures to protect consumers from energy price hikes.

TotalEnergies has been plagued by strikes in France that have led to petrol shortages at pumps.

“Staff are right to call for a 10-percent wage rise” after TotalEnergies’ latest declared profits, tweeted the France Unbowed (LFI) deputy Thomas Portes.

And Patrick Kanner, head of France’s socialists in the upper house, the Senate, argued that TotalEnergies should play their part in the “national effort to allow the poorest to deal with the inflationary crisis”.

President Emmanuel Macron however reiterated his opposition to such a measure in a prime-time television appearance on Wednesday evening.

In Britain, Greenpeace UK made similar arguments about Shell.

“A proper tax on Shell’s reported Q3… profits as well as the billions made in Q1 and Q2 by all the fossil fuel giants would already have generated enough cash to insulate thousands of homes,” said Greenpeace UK’s senior climate advisor Charlie Kronick.

“Responding to the cost-of-living crisis is well within the government’s control.”

Britain’s new prime minister, Rishi Sunak, unveiled a windfall tax on the profits of British energy companies earlier this year when he was finance minister.

But campaigners say it was far too small.

– One-off bonus –

TotalEnergies reached a pay deal with most unions, but one has held out and two refineries remain on strike despite the government forcing some employees back to work under threat of jail time.

The company has also announced it would pay its workers a bonus, “an exceptional one-month-salary bonus in 2022 to all its employees worldwide” it announced Thursday.

Shareholders too will get 35 to 40 percent of cash flow, and a higher interim quarterly dividend than last year.

French Finance Minister Bruno Le Maire welcomed the company’s bumper profits, saying it would allow TotalEnergies to maintain its current discounted prices at service stations.

“When a French company succeeds, I think all of us should be satisfied with its success and we should all be proud of having a big energy company like Total,” he told BFM Business television.

But France’s Multinationals Observatory argued Thursday that TotalEnergies, which they say pays virtually no tax in France, should really pay between 40 and 65 million dollars tax this year.

While oil and gas prices have recently cooled, they are still much higher than before Russia launched its invasion of Ukraine in February.

The war has not been all a boon for TotalEnergies, which was involved in several gas projects in Russia.

It made a new $3.1 billion impairment charge due to its activities there, following write downs worth $7.6 billion in the first two quarters this year.

Despite slower global growth next year, TotalEnergies said it expects a cut of two million barrels per day by the OPEC oil cartel and its allies to support prices, as well as a European ban on Russian oil imports due to go into effect next month.